Corporate Power

Purchase Agreements

The key intricacies of corporate power

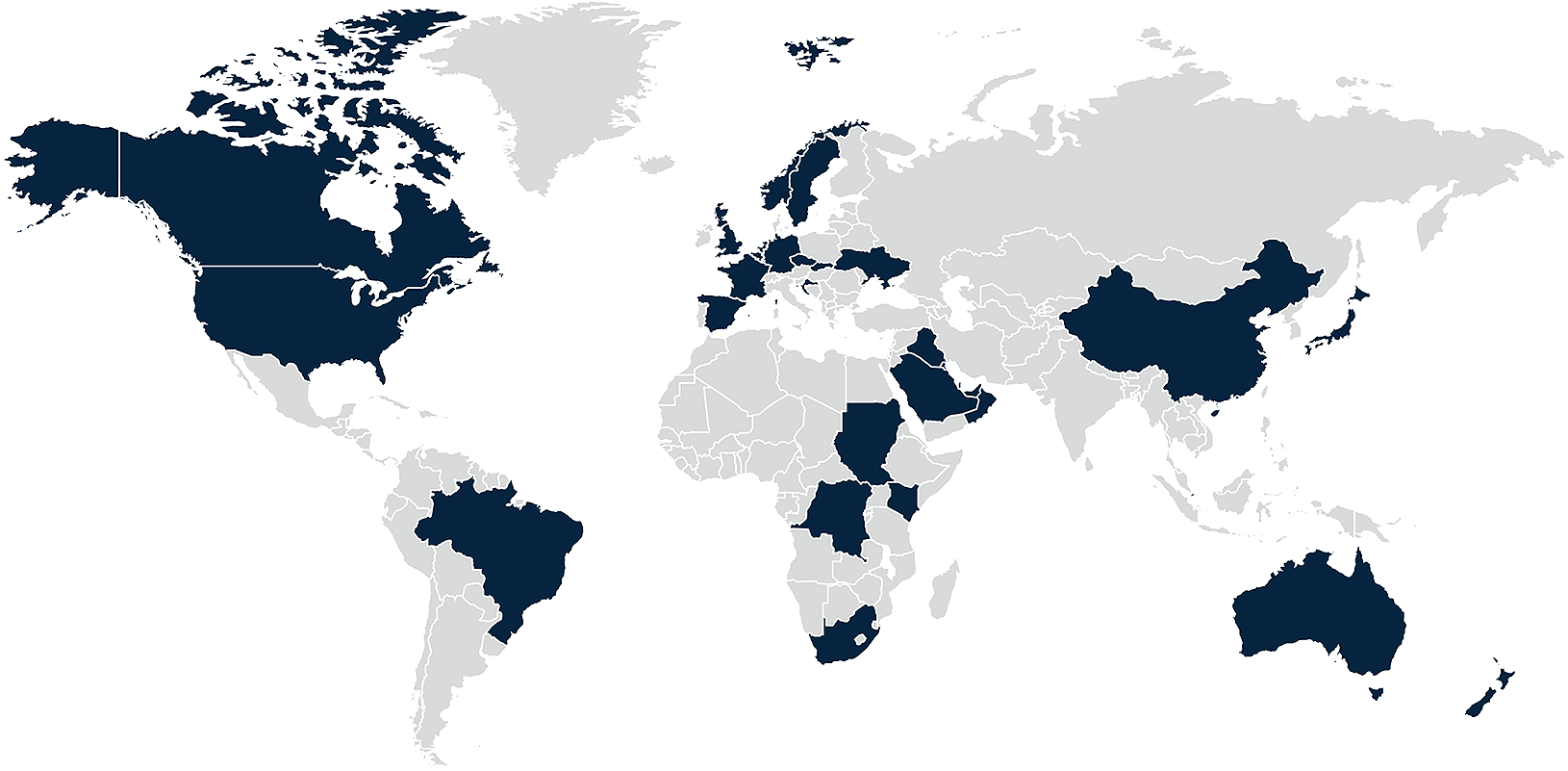

purchase agreements in 25+ countries.

Explore corporate power purchase agreements (PPA) around the world

Navigating the legal, regulatory, and commercial landscape of corporate power purchase agreements across jurisdictions can be complex. Our global comparative guide is designed to be an essential resource for practitioners, in-house counsel, and businesses looking to procure renewable energy. It provides valuable insights into the key legal and commercial considerations in different jurisdictions, helping stakeholders understand the underlying market opportunities, challenges and evolving trends.

If you would like to get in touch with our corporate PPA team, please email

sm-ENRsector@dlapiper.com.

Explore by country

Select a country below to start browsing content.

Corporate PPA glossary

A corporate PPA* is a long-term contract between a renewable energy generator and a corporate buyer or offtaker. These agreements are used for purchasing electricity from generating assets (often renewable sources) and define key terms such as electricity volume, pricing, and delivery risk.

PPAs can be structured for physical delivery of electricity or as financial arrangements. This flexibility makes PPAs an attractive option for businesses looking to secure stable, long-term energy costs while supporting renewable energy projects and meeting their sustainability objectives.

There are several different PPA models, each tailored to different scenarios and requirements. See below for further details.

* As the focus of this Guide is corporate PPAs we have not included below definitions for utility PPAs.

A physical PPA is a direct, long-term contract between a renewable energy generator (seller) and a business (buyer) for the physical delivery of electricity. The buyer agrees to purchase power at a fixed price over the contract term, typically multi-year. In this arrangement, an intermediary (usually an energy supplier or balancing responsible party) is essential to handle the energy transfer from the generator to the consumer. The intermediary integrates the renewable energy into the consumer’s existing supply arrangement, managing any additional energy needs and balancing risks. This process is often referred to as a "sleeving arrangement," or "intermediary" or "BRP" arrangement.

Key points:

- The seller sells electricity to the consumer through the electrical grid.

- The price is usually fixed for the duration of the PPA.

- The seller manages the installation, operation, and maintenance of the renewable energy system.

- The corporate buyer may enter associated arrangements to use the purchased output for their facility's wider load.

- Generators may retain certain risks, such as volume and imbalance, which might require a utility PPA to manage these risks. Often a utility PPA will be required to meet licencing requirements.

Also known as: Sleeved PPA, Direct PPA, Back-to-Back PPA and Wheeling PPA

A financial PPA is a financial arrangement between a renewable energy generator and a buyer. Unlike a physical PPA, there is no physical delivery of electricity. Instead, the energy is sold to the grid, and the buyer and seller settle the power price (typically either for the difference between the agreed-upon price (strike price) and the market price of electricity, or at the market price with a discount). Where a fixed-for-floating model is used then this type of agreement includes a 'contract for difference,' where the buyer pays the generator the difference between the fixed PPA price and the market price. Both models support investment in the renewable asset without the complexity of additional contracts for physical energy transfer between buyer and generator.

Key points:

- These are financial agreements where no electricity is sold directly to the consumer.

- The environmental certificates (such as Renewable Energy Guarantees of Origin, REGOs, RECs, I-RECS) related to the energy generated are sold to the consumer for a fixed price.

- Under the contract for difference model:

- If the generator sells electricity to the market for less than the fixed price, the buyer will make a payment to top it up.

- If the generator sells electricity to the market for more than the fixed price, they will pay the surplus to the buyer.

Also known as: Synthetic PPA, Virtual PPA and Fixed-for-Floating Swap

A private wire PPA involves a renewable energy plant located at or near the consumer’s site which generates electricity and supplies it directly to an end-user via a private wire. This is also known as a “behind the meter” PPA because the electricity is used on-site rather than passing through an electricity meter to the grid. This arrangement reduces grid congestion and avoids costs such as balancing and distribution, though it requires adequate space and can face planning restrictions. There are also typically regulatory requirements relevant to private wire supply (e.g. re licensing exemptions/on-sale, etc.) and therefore a regulatory review of the proposed arrangement may be necessary.

Private wire PPAs are typically used when a generator supplies electricity directly to a single user, such as a factory, bypassing the national grid. These arrangements are beneficial for both parties as they can avoid grid charges and policy costs, offering greater autonomy and potential cost savings. Private wire PPAs are especially useful in scenarios where renewable energy projects need to ensure financial viability amidst reduced subsidies.

Key points:

- The generating facility is closely located to the consumer.

- Power is delivered directly to an end user (by a "private wire") without passing through the grid.

- Typical examples of a private wire PPA are where a corporate uses existing real estate/space, such as roof space for solar panels or other space on, or adjacent to, the site to provide renewable energy directly to the business (e.g., a factory or R&D plant).

Also known as: Direct Wire PPA, Co-located Renewable Energy Facility, On-Site PPA and Behind-the-Meter PPA