Carried Interest

Global Guide

Comparative analysis on how carried interest and phantom carry is taxed across popular jurisdictions for Fund managers

Compare carried interest around the world

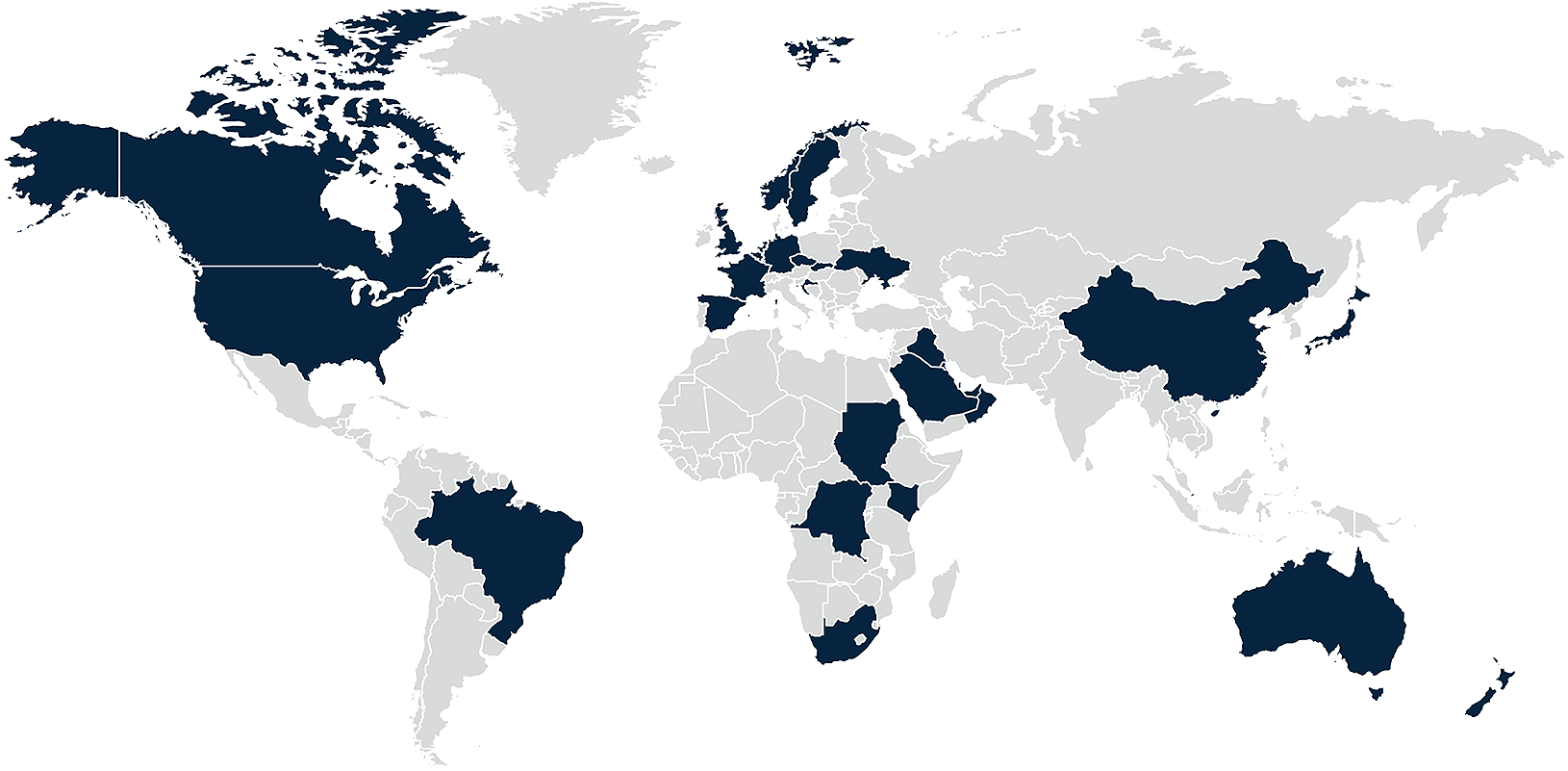

This guide provides an insight into how carried interest and synthetic / phantom carry salary is taxed across 17 jurisdictions, including in the Americas, Europe, Middle East and APAC. The data is up to date as of 30 September 2025.

Carried interest (or carry) is a share of a Fund’s profits – typically 20% – allocated to Fund managers after investors receive back their capital plus a preferred return (the hurdle). It aligns Fund managers’ interests with those of investors by incentivising performance. The Fund management team typically works for the Fund’s advisory entity and receives an annual salary. Senior Fund managers are commonly granted carried interest rights. Investors usually require the Sponsor team to invest personally on similar terms – a practice known as GP commitment or co-invest. The analysis provided here is limited to taxation of carried interest only and not GP commitment / co-invest.

To view the country comparison snapshots, please select your countries and topics by using the dropdown or map below.

Comparative tax rates

This table shows the best possible tax rates, although this will not apply to every Fund. Further detail is set out in the country pages, which you can view via the map below.

Explore by country

Select a country below to start browsing content.

An overview of carried interest

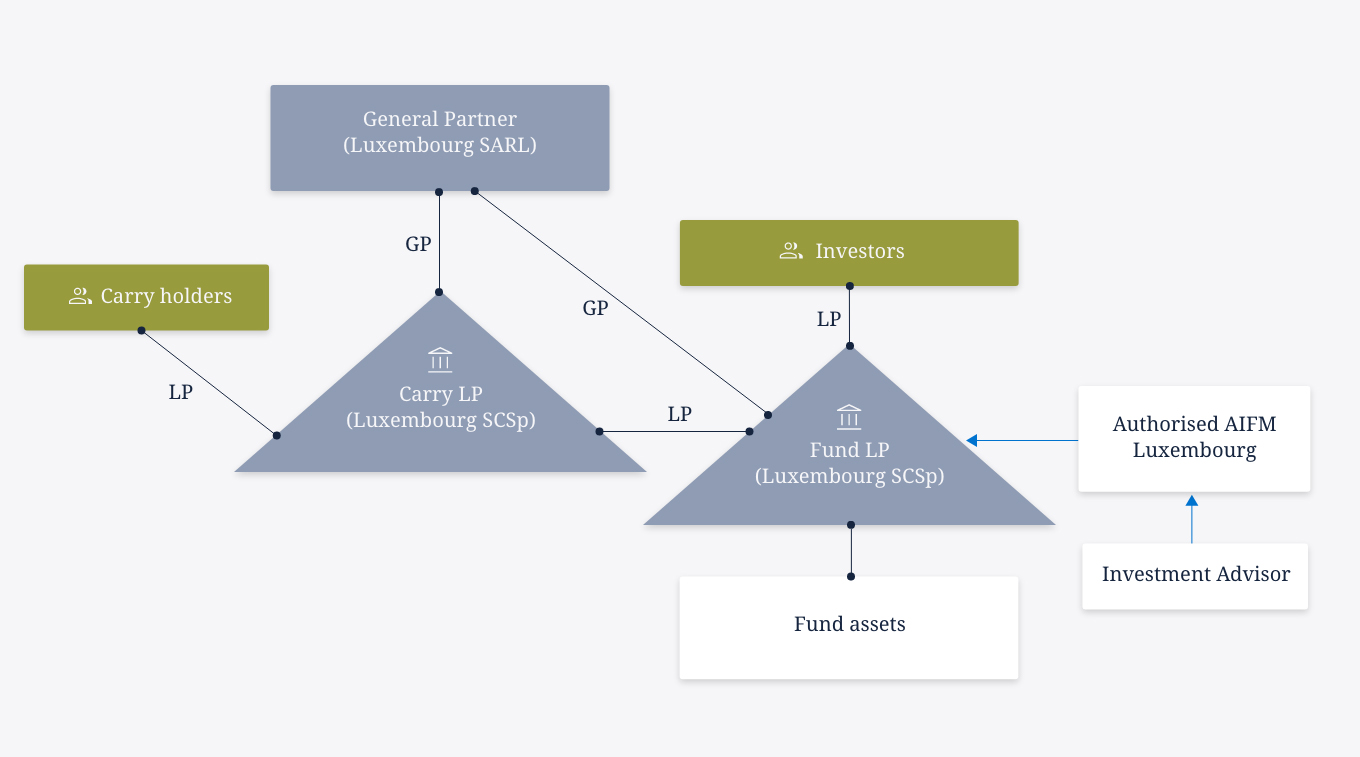

In most jurisdictions carry is held through a carry vehicle: typically structured as a separate limited partnership (e.g. in European Funds) or through the general partner (e.g. US Funds), and the carry holders are admitted as limited partners to the carry vehicle.

One advantage of the carry vehicle is that it provides privacy, as the main Fund limited partnership agreement (LPA) will stipulate that carry is paid to the carry vehicle without disclosing the identity of the carry holders. Furthermore, the carry vehicle provides flexibility with respect to carry, such as admitting new joiners, bad leavers forfeiting carry, and rewarding high performers with additional carry.

Carry is a share of the Fund’s profits and can consist of capital gain (including share buybacks), interest income and dividends. In many jurisdictions the tax rate will vary depending on the nature of the return. Conversely, in other jurisdictions, there is a 'flat tax rate' where the carry is taxed at the same rate regardless of the nature of the return.

See below for a structure diagram of a typical Luxembourg Fund structure.

Tax aspects

There are two main tax events related to carried interest:

- Grant of carry: This occurs when an employee is admitted to the carry vehicle and acquires the right to receive carried interest at a future date.

- Receipt of carry: This happens when carried interest is allocated to the carry vehicle (and subsequently to the carry holders) according to the terms set out in the Fund's distribution waterfall.

Phantom carry

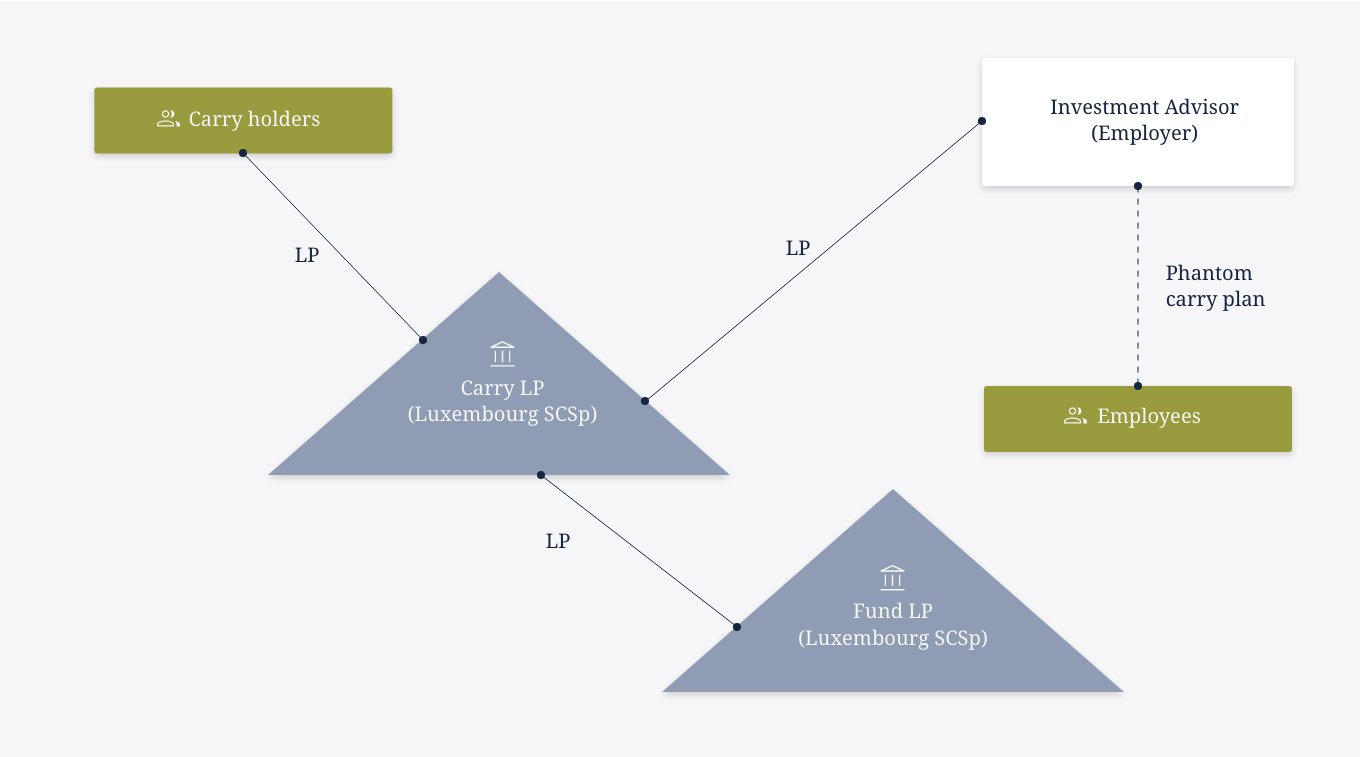

Phantom carry, also known as synthetic carry, is a bonus payment linked to, and often sourced from, carried interest. It is commonly used in jurisdictions where employment tax liabilities apply to the grant of carry, such as for late joiners. Phantom carry is a contractual right to receive future payments of carry, with the scheme's details typically outlined in a letter from the employer to the employee. Phantom carry is a contractual right to receive future payments of carry, with the scheme's details typically outlined in a letter from the employer to the employee.

Phantom carry can be structured in various ways. One structure involves granting carry in the Fund to the employer vehicle. When the employer vehicle receives carry payments, it passes these amounts, net of tax, to the employee. If structured correctly, phantom carry should not incur tax liabilities when the individual is awarded the right to receive future carry payments. This is what we refer to as grant of phantom carry. However upon receipt of carry from the employer, this is usually treated as a bonus, and the individual will therefore be taxed at the higher employment tax rate, which, in many jurisdictions, is processed through payroll.

See below for an example diagram of a typical phantom carry structure.

The analysis and each country synopsis is illustrative only, and no reliance should be given to any information set out therein.

- The tax rates are for the 2025/26 period (precise months in accordance with each jurisdiction’s tax rules).

- The tax rates listed are at their highest marginal rate.

- Unless stated otherwise, city and state tax rates are not included in the table (but they may be referenced in the synopsis).

- The carry holders are assumed to be employees of the Fund manager entity or affiliate.

- Employment / salary tax rates include employee social security (e.g. in the UK, this is national insurance contributions), but not employer social security contributions.

- Unless stated otherwise, the carried interest is assumed to be held by each Fund manager in their personal capacity and not through a personal holding company.

- Unless stated otherwise, where the table indicates “employment tax liabilities” on the grant of carry, this is (broadly) the market / fair value of the carried interest right, less consideration paid by the carry holder.

- All tax rates in the table have been rounded to one decimal point.

- All information in this article is up to date as of 30 September 2025.